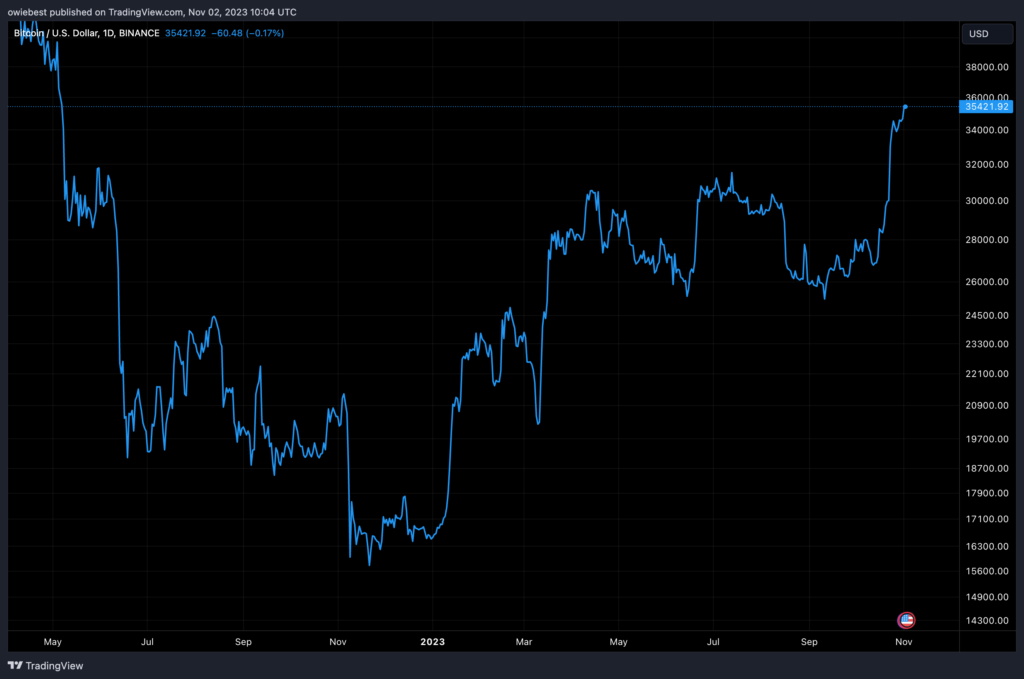

Bitcoin Open Interest Passes $15 Billion as Analyst Warns of Market Volatility

In the ever-evolving world of cryptocurrency, Bitcoin continues to be a dominant force, attracting both retail and institutional investors. In recent times, the open interest in Bitcoin futures markets has surpassed a remarkable $15 billion. While this milestone signals the growing interest in Bitcoin, it also brings with it a heightened need for investors and traders to stay informed about the potential market volatility. In this article, we delve deep into the implications of Bitcoin’s open interest exceeding $15 billion and the warnings issued by industry analysts.

The Significance of Open Interest

Understanding Open Interest

Open interest is a critical metric in the cryptocurrency futures market. It represents the total number of outstanding contracts that have not been settled or offset by delivery. A rising open interest typically indicates a growing market, showcasing an influx of investors and traders engaging in Bitcoin futures.

Market Liquidity and Volatility

High open interest can be a double-edged sword. On one hand, it signifies liquidity in the market, allowing for smoother trading. On the other hand, it can lead to increased market volatility. With more participants in the market, the potential for rapid price swings and sudden market shifts becomes more pronounced.

Bitcoin’s Journey to $15 Billion Open Interest

Factors Behind the Surge

Several factors have contributed to the recent surge in Bitcoin’s open interest:

Institutional Investments: Institutional investors have shown a growing appetite for Bitcoin, with renowned companies and funds allocating a portion of their portfolios to the cryptocurrency.

Growing Retail Interest: Retail investors have flocked to Bitcoin, drawn by the potential for substantial returns and the increasing availability of user-friendly platforms.

Global Economic Uncertainty: Amid economic uncertainties and currency devaluation, Bitcoin is seen by some as a hedge against inflation and a store of value.

Analyst Warnings

Market Oversaturation

As Bitcoin’s open interest surpasses $15 billion, some industry analysts have raised concerns about the market becoming oversaturated. They warn that this level of activity may not be sustainable in the long term, and a market correction could be on the horizon.

Potential Regulatory Impacts

With increased scrutiny from regulatory bodies worldwide, the cryptocurrency market faces the risk of stricter regulations, which could impact open interest and market dynamics. Analysts advise investors to stay updated on the evolving regulatory landscape.

Risk Management

Analysts emphasize the importance of implementing effective risk management strategies in such a volatile market. Diversification of investments and setting stop-loss orders are among the recommended practices to navigate the market’s uncertainties.

Conclusion

Bitcoin’s open interest exceeding $15 billion is a testament to the cryptocurrency’s growing prominence in the financial world. However, it also brings to the forefront the need for caution and awareness of potential market volatility. As an investor or trader, staying informed about the market, understanding open interest, and heeding the warnings of analysts are essential to making informed decisions in the ever-changing landscape of cryptocurrency.

Bitcoin Open Interest Passes $15 Billion as Analyst Warns of Market Volatility Read More »